(NEW YORK)–Ludlow Research issued research alert to its subscribers on Q BioMed Inc. (OTCQB: QBIO), a biotech acceleration and commercial stage company focused on licensing and acquiring undervalued biomedical assets in the healthcare sector, with $0.10+ price target based on current market cap valuation, and potential for its Liver cancer drug patent.

On Feb. 10, 2023, the company announced it expected to receive a patent in the United States for its Liver cancer drug Uttroside B, adding to the already issued patents in Korea, Canada and Japan.

Uttroside B has received Orphan Drug designation from the FDA, with recent results from pre-clinical pharmacokinetic testing have been very encouraging and the data supports advancing the program.

The pending Patent is titled "Uttroside-B and Derivatives Thereof as Therapeutics for Hepatocellular Carcinoma (HCC).

Price Valuation

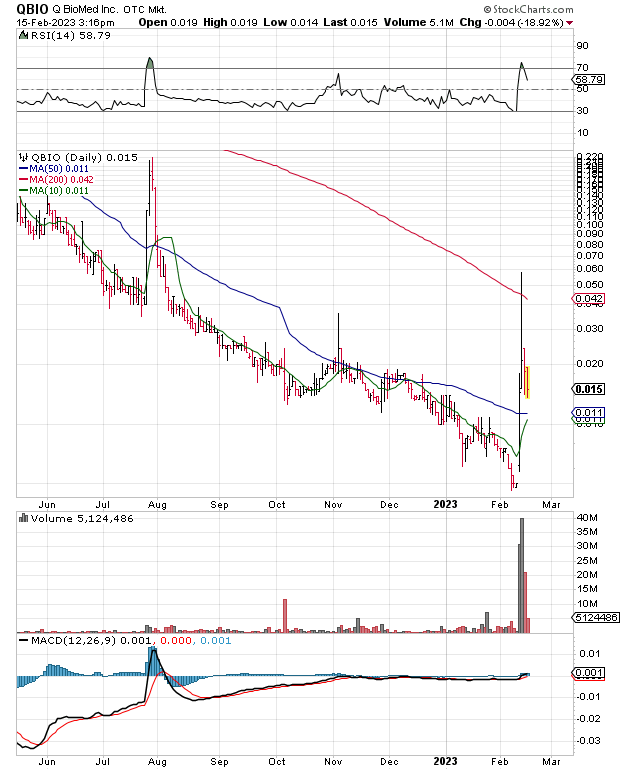

As of Feb. 13, 2023, QBIO had roughly 122 million shares outstanding giving it a current market cap valuation of just $2 million at $0.016 per share.

Based on the potential value for Uttroside B, a price of $0.10 per share in QBIO would still only equate to a market valuation of $12 million, based on its current share structure.

For these reasons, Ludlow Research issued short-term 'speculative' target range of .10 to .15 per share, which could still be very conservative in our opinion.

Subscribe to receive investor updates on this report

https://ludlowresearch.com/investors/

About Q BioMed Inc.

Q BioMed Inc. is a biotech acceleration and commercial stage company focused on licensing and acquiring undervalued biomedical assets in the healthcare sector. Q BioMed provides these target assets the strategic resources, developmental support, and expansion capital needed to ensure they meet their developmental potential, enabling them to provide products to patients in need. http://www.QBioMed.com

Disclosures and Disclaimer:

THE MATERIAL HEREIN DOES NOT CONSTITUTE AN OFFER OR SOLICITATION IN ANY JURISDICTION WHERE OR TO ANY PERSON TO WHOM IT WOULD BE UNAUTHORIZED OR UNLAWFUL TO DO SO.

This reports contains certain statements that may be deemed “forward-looking” statements. Forward looking statements are statements that are not historical facts and are generally, but not always, identified by the words “expects”, “plans”, “anticipates”, “believes”, “intends”, “estimates”, “projects”, “potential” and similar expressions, or that events or conditions “will”, “would”, “may”, “could” or “should” occur. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in forward looking statements. Forward looking statements are based on the beliefs, estimates and opinions of the Company’s management on the date the statements are made. Except as required by law, the Company undertakes no obligation to update these forward-looking statements in the event that management’s beliefs, estimates or opinions, or other factors, should change.

Ludlow Research (“Ludlow”), and its parent company Ludlow Consulting, LLC, are not registered broker-dealers or investment advisers with the U.S. Securities and Exchange Commission, the Financial Industry Regulatory Authority (“FINRA”), or any state securities regulatory authority.

Content contained herein includes facts, views, opinions and recommendations of individuals and organizations deemed of interest. Ludlow does not guarantee the accuracy, completeness or timeliness of, or otherwise endorse these views, opinions or recommendations, or give investment advice. Ludlow, its affiliates, or directors, may or may not hold a position in the above security from time to time, and investors are encouraged to consider this as a possible conflict of interest when reviewing this information. In Compliance with SEC Rule 17B Ludlow was not compensated for this research alert. Investments is speculative ‘penny stocks’, as defined by the SEC, may involve a high degree of risk.

INVESTORS ARE HIGHLY ENCOURAGED TO CONSULT WITH A FINANCIAL ADVISOR BEFORE MAKING ANY AND ALL INVESTMENT DECISIONS.

Interested in research report for your company?

Contact Us