(NEW YORK)–International Business Machines Corp (NYSE:IBM) saw its stock drop sharply after reporting fairly decent earnings on foreign currency exchange concerns with stronger US dollar.

IBM reported a 16% revenue growth rate in Q2 2022. when excluding foreign currency exchange rates, and has greatly outperformed the market being down 2%, versus an 18% drop for the S&P 500 index.

Propelling IBM revenues higher were tech infrastructure sales, thanks to a new generation of Z Systems cloud and hybrid cloud computers, and consulting, which grew at 18%.

Value Tech and High Dividend

The recent rally in growth equities may be short lived and may see investors roll back into stocks with low PE’s and solid dividend yields.

IBM currently has a Forward PE of 13, and Dividend Yield of 5.2%, making it an excellent technology value play on any market volatility.

Chart Indicates Oversold

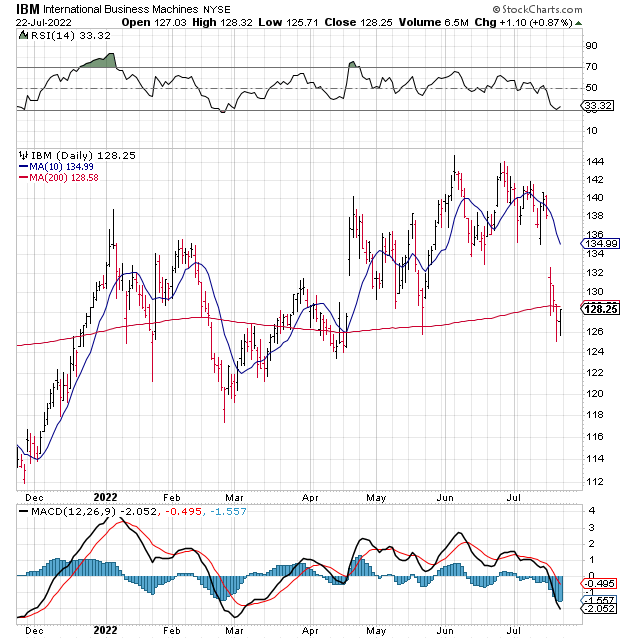

IBM is down nearly 11% off recent highs in mid-June and closed just below its key 200-day moving average around $128. The RSI on IBM chart is now just above 30 indicating oversold conditions and may offer a good entry point for traders.

Based on potential swing back from Growth to Value, a weakening US Dollar, and charts oversold conditions, we feel IBM may offer good entry point for potential move back to mid-$130s to $140+ as solid value tech play.

About IBM

International Business Machines Corporation provides integrated solutions and services worldwide. The company operates through four business segments: Software, Consulting, Infrastructure, and Financing. The Software segment offers hybrid cloud platform and software solutions, such as Red Hat, an enterprise open-source solutions; software for business automation, AIOps and management, integration, and application servers; data and artificial intelligence solutions; and security software and services for threat, data, and identity. This segment also provides transaction processing software that supports clients’ mission-critical and on-premise workloads in banking, airlines, and retail industries. The Consulting segment offers business transformation services, including strategy, business process design and operations, data and analytics, and system integration services; technology consulting services; and application and cloud platform services. The Infrastructure segment provides on-premises and cloud-based server and storage solutions for its clients’ mission-critical and regulated workloads; and support services and solutions for hybrid cloud infrastructure, as well as remanufacturing and remarketing services for used equipment. The Financing segment offers lease, installment payment, loan financing, and short-term working capital financing services. The company was formerly known as Computing-Tabulating-Recording Co. International Business Machines Corporation was incorporated in 1911 and is headquartered in Armonk, New York. www.ibm.com